- 4D MOLECULAR THERAPEUTICS IPO TRIAL

- 4D MOLECULAR THERAPEUTICS IPO LICENSE

- 4D MOLECULAR THERAPEUTICS IPO PLUS

Rosenwald, M.D., Fortress’ Chairman, President and Chief Executive Officer and Aevitas’ Executive Chairman, said, “This agreement with 4DMT allows Fortress to focus on acquiring and developing clinical-stage treatments, while potentially expediting the development and commercialization of this preclinical sCFH technology. Wenchao Song, a Professor of Pharmacology at the Perelman School of Medicine.

4D MOLECULAR THERAPEUTICS IPO LICENSE

The aforementioned payments are payable solely to Aevitas, and 4DMT will be responsible for license payment obligations to University of Pennsylvania, where the sCFH technology was co-invented and co-developed by Dr. A range of single-digit royalties on net sales are also payable. Under the terms of the agreement, 4DMT will make cash payments to Aevitas totaling up to ~$140 million in potential late-stage development, regulatory and sales milestones.

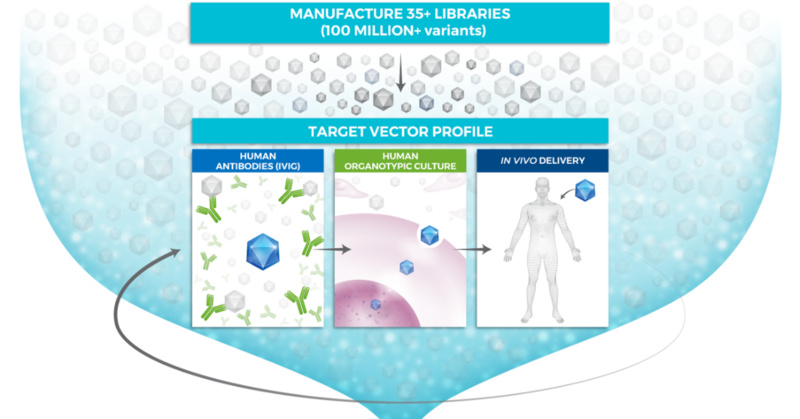

(Nasdaq: FBIO) (“Fortress”) subsidiary company, and 4D Molecular Therapeutics (Nasdaq: FDMT) (“4DMT”), a clinical-stage biotherapeutics company harnessing the power of directed evolution for genetic medicines targeting large-market diseases, today announced the execution of an asset purchase agreement for 4DMT to acquire Aevitas’ proprietary rights to its short-form human complement factor H (“sCFH”) asset for the treatment of complement-mediated diseases. MIAMI, Ap(GLOBE NEWSWIRE) - Aevitas Therapeutics, Inc.

4D MOLECULAR THERAPEUTICS IPO PLUS

It is expected to price during the week of December 7, 2020.Company is eligible to receive up to ~$140 million in potential late-stage development, regulatory and sales milestone payments plus royalties from 4DMT Goldman Sachs, BofA Securities and Evercore ISI are the joint bookrunners on the deal. It plans to list on the Nasdaq under the symbol FDMT.

It has two additional candidates that it expects to file INDs for in the 2H21.ĤD Molecular Therapeutics was founded in 2013 and booked $17 million in collaboration and license revenue for the 12 months ended September 30, 2020.

4D MOLECULAR THERAPEUTICS IPO TRIAL

Its lead candidates include 4D-125, which is currently in a Phase 1/2 trial for X-linked retinitis pigmentosa with initial data expected in 2021 4D-110, which is currently in a Phase 1 trial for choroideremia with initial data expected in 2022 and 4D-310, which is currently in a Phase 1/2 trial for Fabry disease with initial data expected in 2021. At the midpoint of the proposed range, 4D Molecular Therapeutics would command a fully diluted market value of $491 million.ĤD is developing product candidates using its targeted and evolved AAV vectors, initially focusing on ophthalmology, cardiology, and pulmonology. The Emeryville, CA-based company plans to raise $100 million by offering 4.8 million shares at a price range of $20 to $22. 4D Molecular Therapeutics, which is developing targeted gene therapies for multiple diseases, announced terms for its IPO on Monday.

0 kommentar(er)

0 kommentar(er)